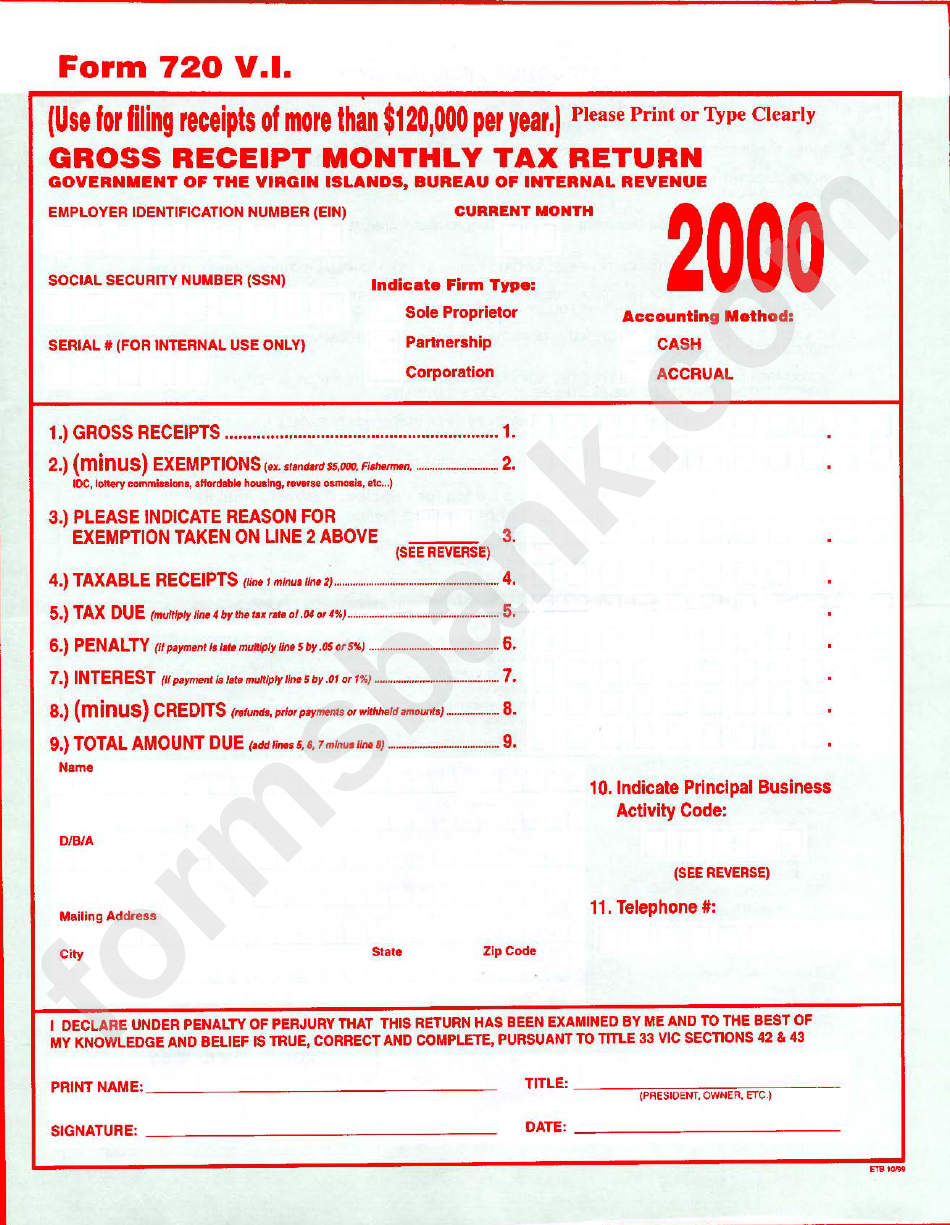

Subject to other disqualifying conditions set forth at MCL 206.671, the credit is available to a taxpayer with gross receipts that do not exceed $20,000,000 for the tax year. A taxpayer whose gross receipts exceed this amount must file a return and pay the tax.įinally, gross receipts are used to determine whether a taxpayer qualifies for a small business alternative credit under MCL 206.671. Gross receipts of affiliates are calculated as follows: Gross receipts of a borrower with affiliates is calculated by. A taxpayer, other than an insurance company or a financial institution, whose apportioned or allocated gross receipts are less than $350,000 is not required to file a return or pay the tax imposed under the CIT. To be eligible to elect to pay the gross receipts tax, the person or entity must have received less than 50 million in annual gross operating revenues within. All other items, such as subcontractor costs, reimbursements for purchases a contractor makes at a customers request, investment income, and employee-based costs such as payroll taxes, may not be excluded from gross receipts. Second, gross receipts are used as a threshold to determine whether a taxpayer is required to file an annual CIT return and pay the tax. Therefore, the amount of a taxpayer's gross receipts, in conjunction with active solicitation of sales, is determinative of whether a taxpayer has nexus in Michigan. One of these is that a taxpayer has nexus with Michigan if the taxpayer actively solicits sales in Michigan and has gross receipts of $350,000 or more sourced to Michigan. There are three separate alternative nexus standards under the CIT. First, gross receipts are used to determine whether a taxpayer has nexus in Michigan.

0 kommentar(er)

0 kommentar(er)